Defending new payment technology is leaving traditional transactions undefended. As financial institutions rush to secure emerging transaction types, they risk increased exposure to traditional fraud.

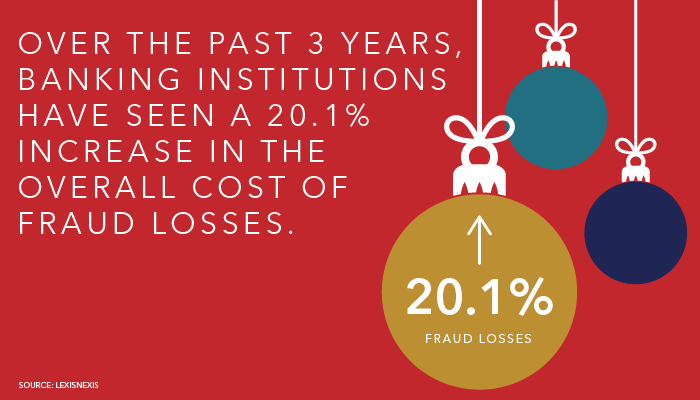

As the holiday season gets underway, banks are bracing themselves for the seasonal influx of fraudulent transactions. While financial institutions are increasingly adopting fraud prevention

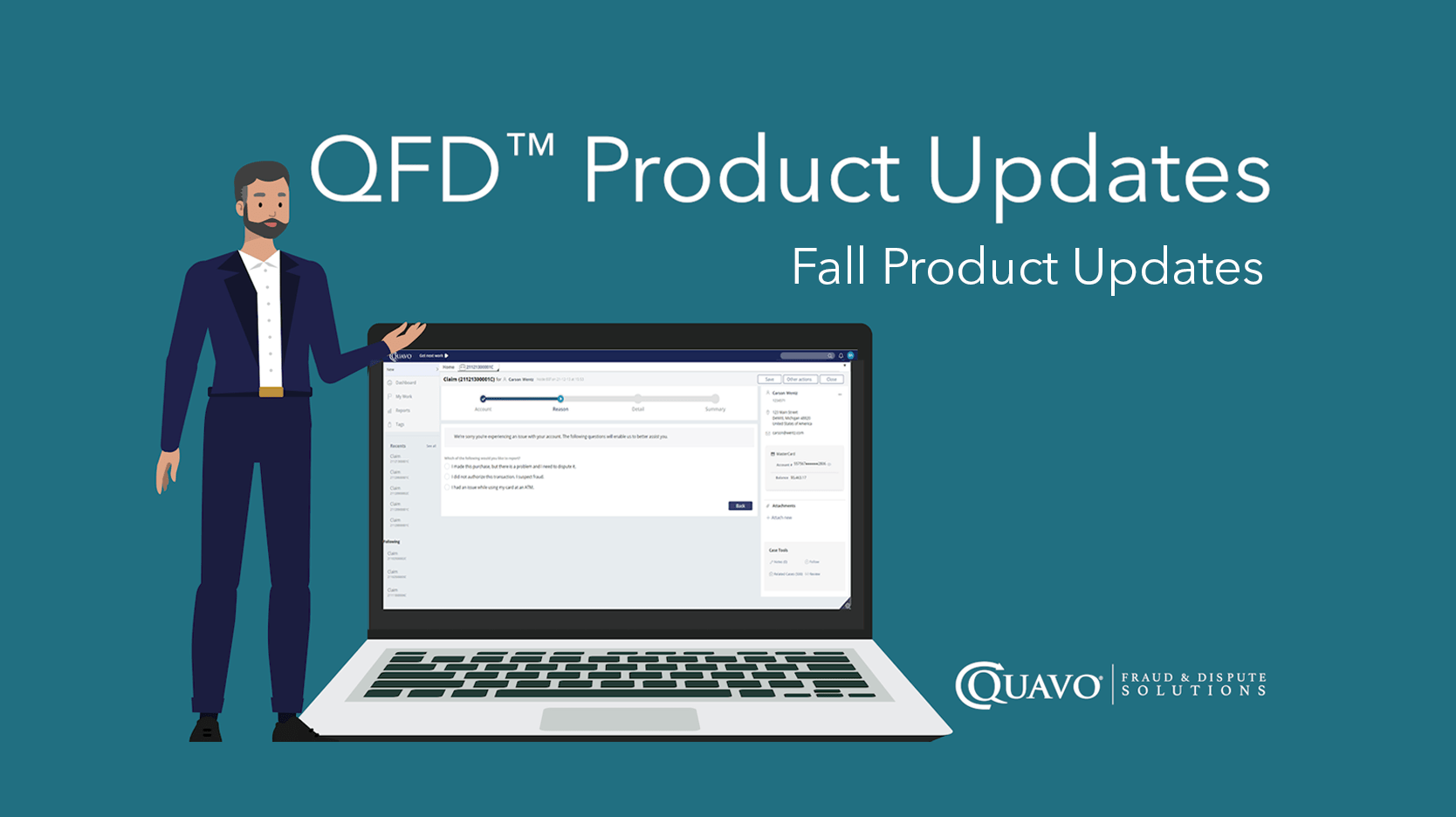

Quavo Experts compiled everything issuers need to know regarding the October 2022 Visa/Mastercard chargeback mandate updates. The enacted changes will go into effect on October

Quavo experts compiled everything issuers need to know regarding the April 2022 Visa/Mastercard chargeback mandate updates. The enacted changes will go into effect on April

Bi-annual association updates are lengthy, time-consuming, and confusing! Following the October 2021 VISA/Mastercard mandate changes, Quavo experts have spent time processing each reason code and

ARN (Acquirer Reference Number) access is crucial to streamlining the chargeback management process for financial institutions and Fintech organizations. Financial institutions can engage in a

Predicted CFPB Changes Under the Biden Administration As the new Biden Administration revisits the actions taken by Obama and Trump in the Bureau, how will

By submitting your information, you agree to Quavo’s Terms of Service and Privacy Policy.