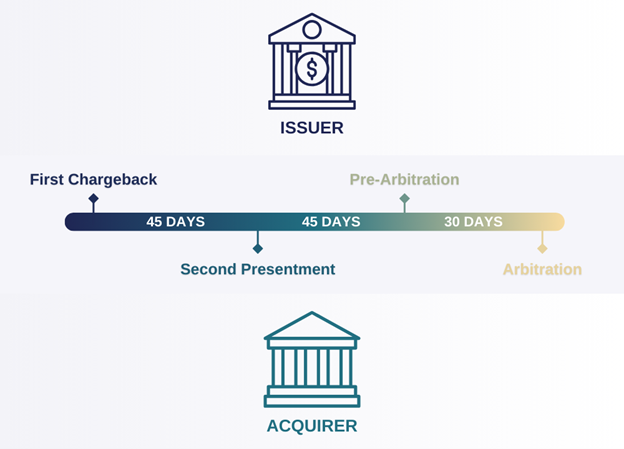

In 2021, Mastercard® announced new mandates regarding pre-arbitration and arbitration case filing for chargebacks. The arbitration chargeback cycle was replaced with pre-arbitration where applicable. Pre-arbitration is now required for fraud, cardholder disputes and POI error reason codes prior to escalating as an arbitration case.

You might be wondering, what exactly is pre-arbitration?

In pre-arbitration, the issuing and acquiring financial institutions (FIs) communicate to exchange the data required for case resolution.

Pre-arbitration is the last stage before a disputed transaction is escalated to the Association (i.e. Visa, Mastercard, AMEX) for arbitration.

Disputes may go to pre-arbitration if:

- The issuing bank isn’t satisfied with the evidence presented by the merchant

- The merchant provides sufficient information, but the accountholder provides new details

- The accountholder presents a different reason for the chargeback

Keeping up with mandate changes can be complicated. Quavo’s QFD® fraud and dispute management platform automatically keeps you and your team compliant with built-in regulatory-driven workflows. Contact an expert to find out more.